Stocks have been sinking for weeks — but all isn’t lost.

To say that now is a difficult time to be an investor would be an understatement. The stock market has been volatile since the start of the year, and now that stocks are in correction territory, it’s hard for investors to get excited about their prospects.

If recent stock market movement has left you feeling bummed out — and burned out — you’re no doubt in good company. But here’s why you shouldn’t let the events of the past few months get you down.

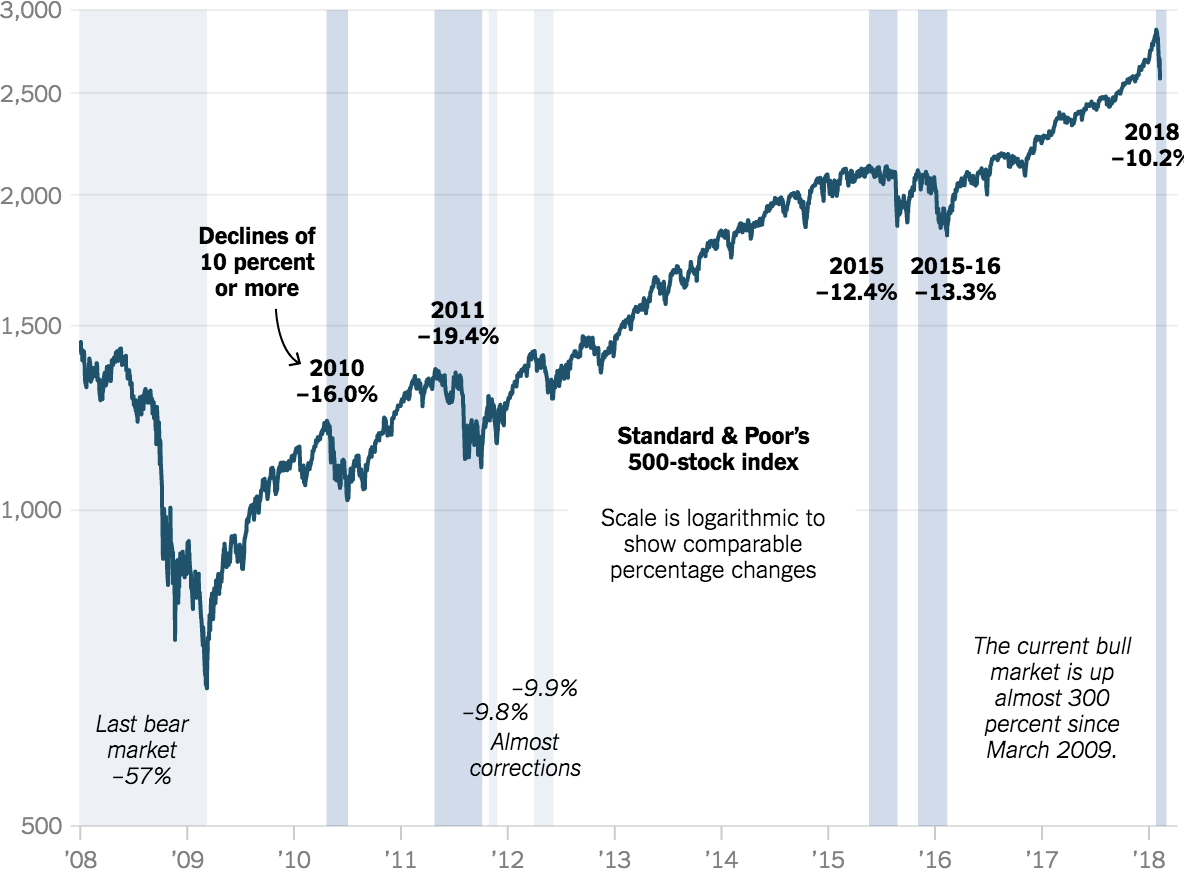

Stock market corrections are normal

If you’re a fairly new investor, this may be the first stock market correction you’ve encountered. But if you’re a seasoned investor, it’s fair to say that you’ve probably been through a correction before. And just as things probably worked out during the last stock market dip, so too should you have faith that stocks will recover from this current blip.

In fact, data shows that stock market corrections — periods when stocks lose 10% of their value or more — occur every 19 months on average. That’s based on patterns dating back to 1928. So while today’s correction may be hitting you hard, the reality is that the market was actually due for one.

What’s more important to focus on is recovery — namely, the fact that the market has managed to regain its value following a correction throughout history. And there’s no reason to think today’s situation will be different.

Stock market corrections can lead to buying opportunities

For the past two years, stock values have been sky-high. That may have seemed like a great thing, but at the same time, it’s been really difficult to buy stocks due to so many companies being overvalued.

Now that we’re in the midst of a correction, investors have an opportunity to load up on stocks while they’re discounted. If there are specific companies you’ve been wanting to scoop up but haven’t, now may be the time to add them to your portfolio.

If you’re uneasy about the idea of buying individual stocks, you can always fall back on broad market ETFs, or exchange-traded funds. The beauty of ETFs is that they allow you to invest in a whole bunch of different companies without having to research each one individually.

Keep the faith

The past number of weeks have been hard on investors, and it’s easy to see why you may be feeling deflated and doomed. But remember, not only are stock market corrections fairly common occurrences, they can also help investors carve out opportunities to build up their portfolios and set themselves up for long-term growth.

We don’t know how long it will take for stock values to recover from the hit they’ve taken recently. Historically, it’s taken the market about four months to regain its value in the wake of a correction, but that doesn’t guarantee the same will happen this time around. Your best bet as an investor, therefore, is to stay cool, keep the faith, and use today’s stressful circumstances as an opportunity to set yourself up for future success.

10 stocks that could be the biggest winners of the stock market crash

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

They just revealed what they believe are the ten best buys for investors right now… And while timing isn’t everything, the history of their stock picks shows that it pays to get in early on their best ideas.